Publications

“Liquidity Risk and Funding Cost” (with Alexander Bechtel and Angelo Ranaldo)

Review of Finance, Forthcoming

(Download)

“Unsecured and Secured Funding” (with Mario Di Filippo and Angelo Ranaldo)

Journal of Money, Credit and Banking, 2022, Vol. 54, Pages 651–662

(Download)

“The Euro Interbank Repo Market” (with Loriano Mancini and Angelo Ranaldo)

The Review of Financial Studies, 2016, Vol. 29, No. 7, Pages 1747–1779

(Download | Internet Appendix | BibTeX)

“Liquidity in the Foreign Exchange Market: Measurement, Commonality, and Risk Premiums” (with Loriano Mancini and Angelo Ranaldo)

Journal of Finance, 2013, Vol. 68, No. 5, pp. 1805-1841

(Download | Internet Appendix | BibTeX | Fx liquidity index data | Related article on VoxEU.org)

- Award: Eastern Finance Association Outstanding International Finance Paper (2010).

- Coverage in: FT Alphaville

“The Joint Dynamics of Hedge Fund Returns, Illiquidity, and Volatility”

The Journal of Alternative Investments, 2012, Vol. 15, No. 1, pp. 43-67

(Download | Internet Appendix | BibTeX)

Working papers

“Non-Standard Errors” (First crowd-sourced empirical paper in Finance with 342 coauthors)

TI Discussion Paper 21-102/IV

(Download, Project website)

“Reserve Tiering and the Interbank Market” (with Lucas Marc Fuhrer, Matthias Jüttner, and Matthias Zwicker)

Swiss National Bank Working Paper No. 2021-17

(Download)

“The ‘New Normal’ During Normal Times – Liquidity Regulation and Conventional Monetary Policy“ (with Sînziana Kroon, Clemens Bonner and Iman van Lelyveld)

DNB Working Paper 703

(Download)

“Funding Illiquidity” (with Matthias Rupprecht)

University of St.Gallen, School of Finance Research Paper No. 2016/01

(Download)

“Ambiguity and Reality” (with Fabio Trojani and Christian Wiehenkamp)

Swiss Finance Institute Research Paper No. 11-33

(Download | Internet Appendix)

Data

For academic research purposes only.

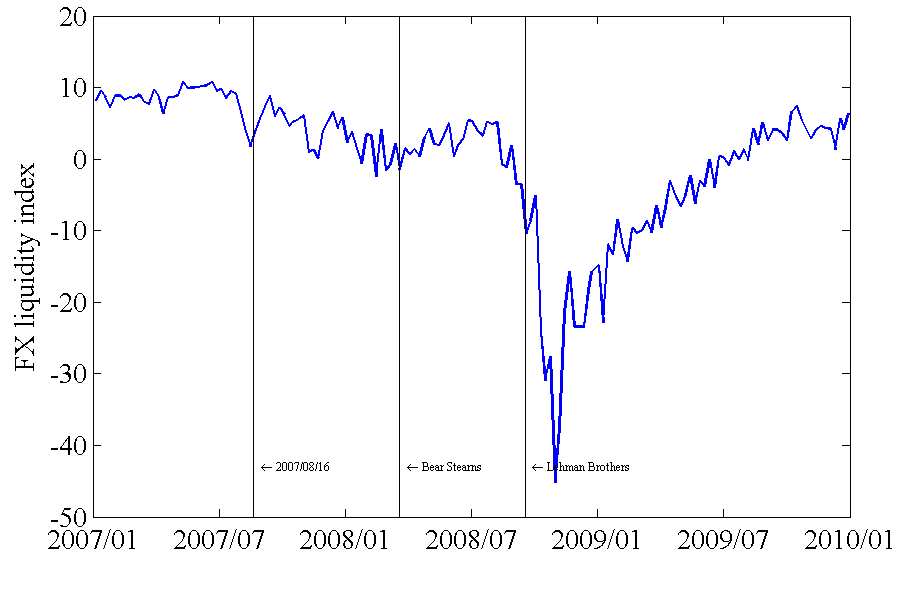

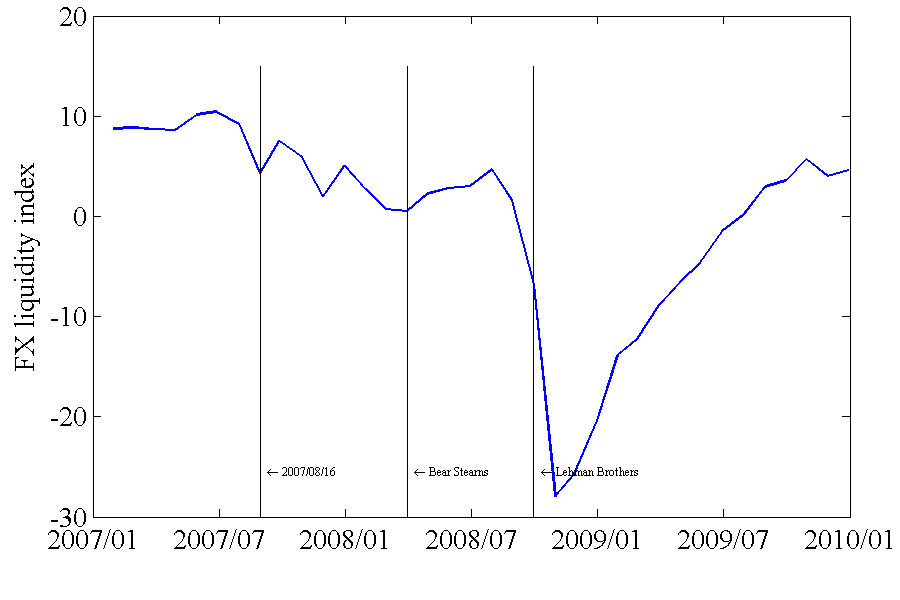

“Liquidity in the Foreign Exchange Market: Measurement, Commonality, and Risk Premiums”

Market-wide FX liquidity index data

The market-wide FX liquidity index is obtained from principle component analysis across different liquidity measures and various exchange rates. Namely, it is constructed using price impact, return reversal, bid-ask spread, effective cost, and price dispersion as liquidity measures and the AUD/USD, EUR/CHF, EUR/GBP, EUR/JPY, EUR/USD, GBP/USD, USD/CAD, USD/CHF, and USD/JPY exchange rates.Download data:

Excel

CSV (monthly data)

CSV (weekly data)

Plot of monthly data:

Plot of weekly data: